Maximize Cash Flow with Smart Payment Collection Software!

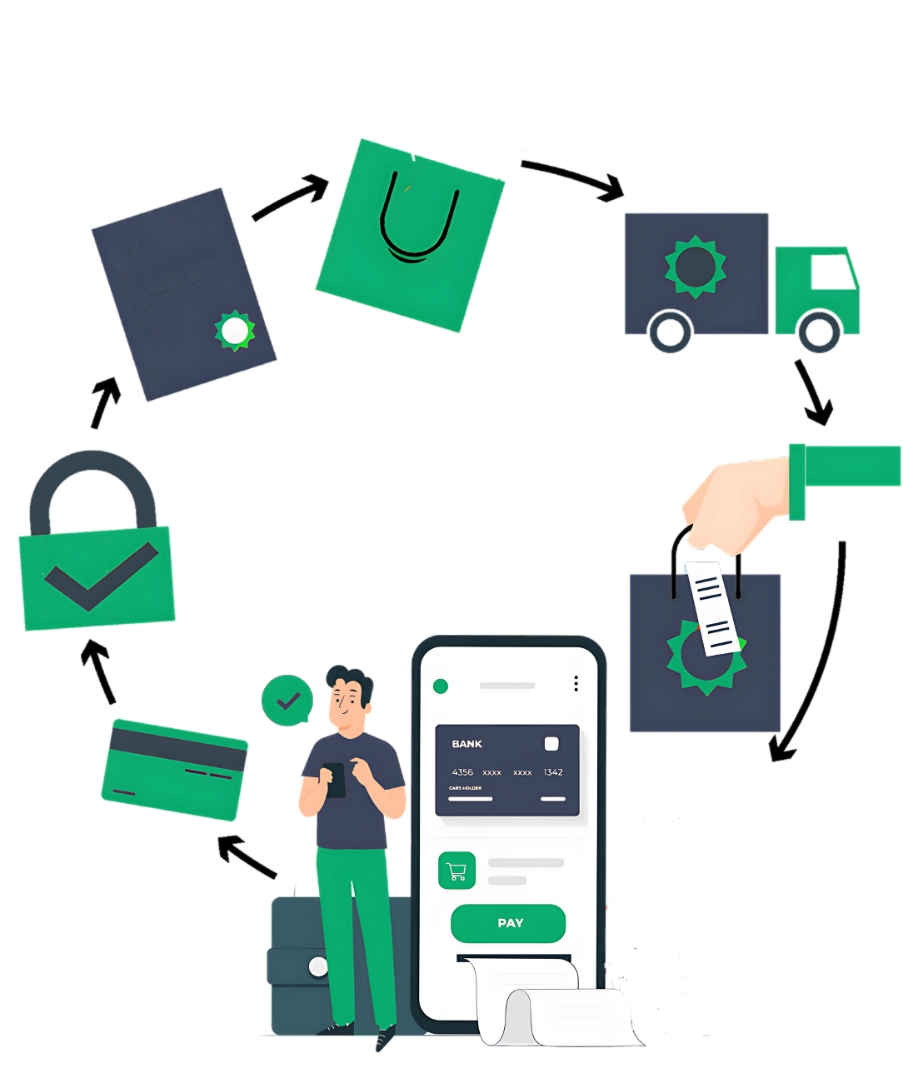

ECCOLLECT simplifies and automates your payment collection process, ensuring real-time tracking and improved cash flow with secure payment gateway integration, automated reminders, and insightful reporting, business can enhance efficiency and reduce delays. Whether you're a small business or a large enterprise, ECCOLLECT provides a seamless, reliable, and professional payment collection solution.

.png)